110 Yonge

Sold

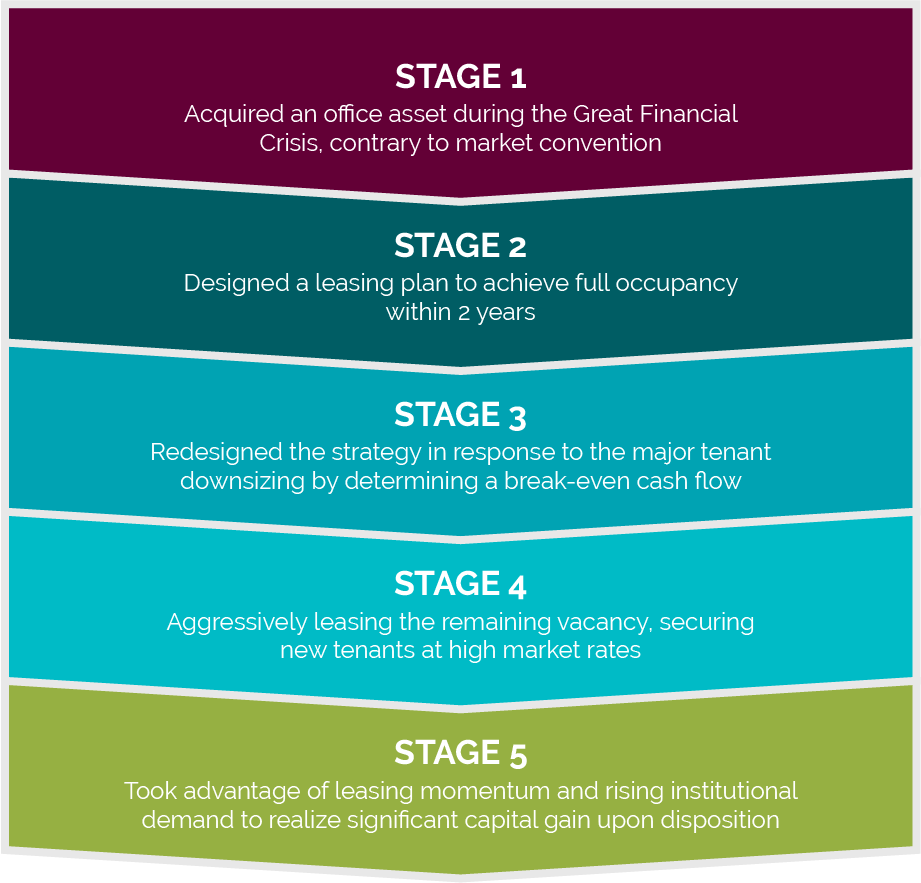

Taking advantage of the lack of capital for real estate during the financial crisis of 2008/2010, we purchased a 50% interest in 110 Yonge at the 3rd Quarter of 2009. Within 2 years, we successfully reached full occupancy and enjoyed ~9% increase in market rental rates. Shortly thereafter, and despite assurances to the contrary, the anchor tenant accounting for ~40% of the building only renewed half of their space. We promptly initiated an aggressive leasing strategy and in less than 24 months attained 91% occupancy; a significant accomplishment considering the office market dynamics at the time. We once again took advantage of market timing, quickly identifying the early stages of a rising demand in office properties by institutional investors, and sold our interest in the property by Q3/2013; representing a 275 bps Cap Rate compression during our period of ownership.

Early recognition of a scarcity in real estate capital leading to an exceptional office acquisition opportunity

Devised a value-add strategy while respecting prudent financial management in an economically challenging environment

Identified a favorable exit strategy and achieved a significant return on investment