A Proven Investment Strategy Through Acquisition & Asset Management

Investing on behalf of private high net worth and institutional investors means it is critical for Bayfield to provide the best real estate investment strategy that secures a consistent and growing cash flow while protecting investors from today’s turbulent market conditions. Our proven track record has shown our clients how commercial real estate can be a stable, alternative investment to high risk vehicles such as purchasing options, high yield bonds, and currency trading. Our philosophy is to ensure our investment strategy is well-executed to limit the impact of any uncontrollable fluctuations that may arise in the market.

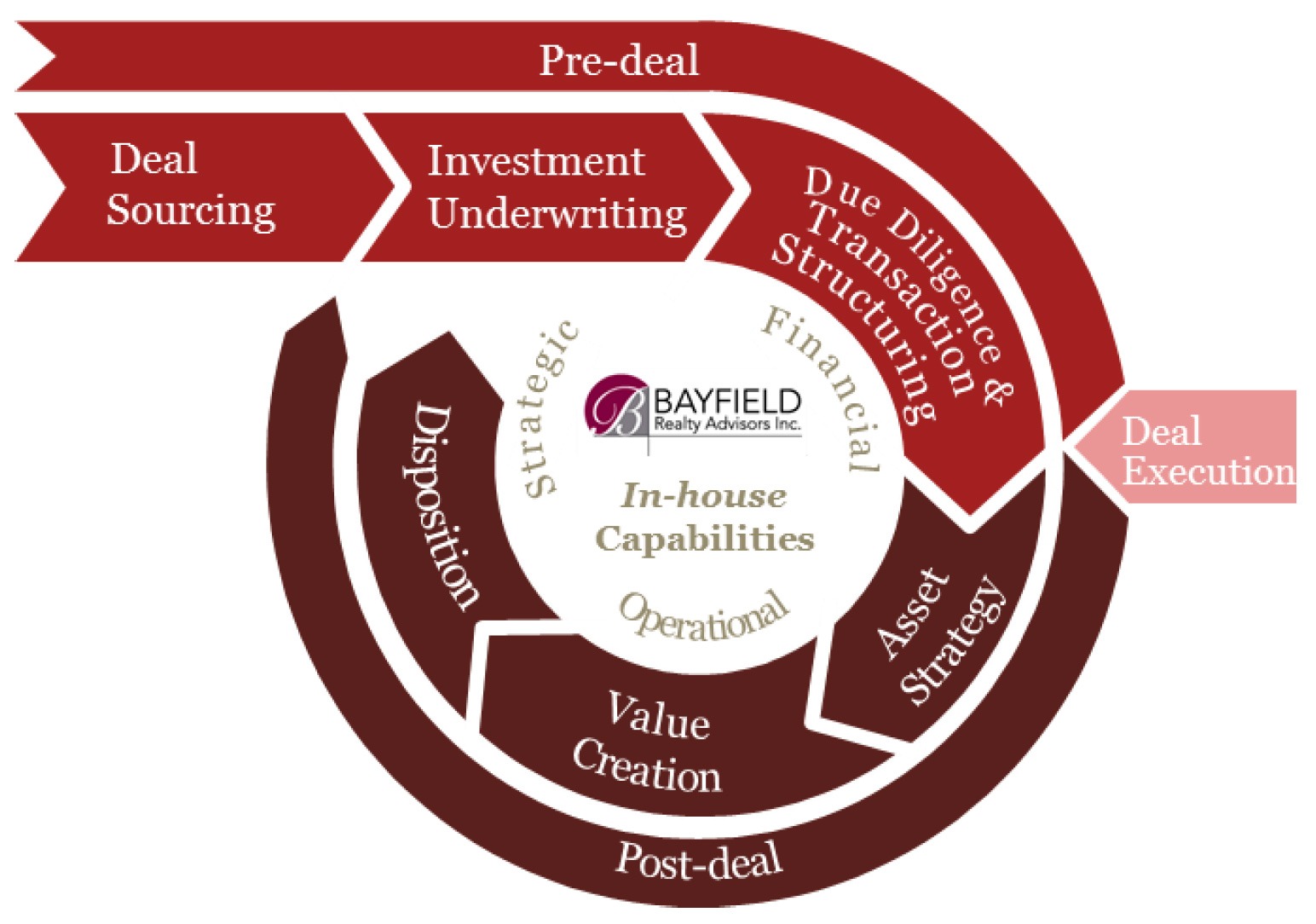

Disciplined Investment Process

Full suite of in-house capabilities throughout the investment cycle to capitalize on Bayfield’s strategic opportunities

Bayfield’s core competency: focus on attractive secondary markets (but not preclude primary markets) to maximize return opportunities

Bayfield's key strategic elements

Market Trend Aligned

Capitalize on current and projected retail and industrial trends

Retail – Target centres with expanding high touch-point tenants such as grocers, restaurants, medical and personal services

Industrial – Focus on two types:

“Last-mile” distribution — e-commerce related space

Multi-tenant flex industrial — widest range of tenants and tight rental market

Stabilized with Income Appreciation

Focusing on value creation opportunities through enhanced property and asset management, exploit embedded growth (below market rents), redevelopment opportunities (anchor, food court), lease-up under-managed space, retenanting, implement remerchandising programs

Mass Transit Oriented

Acquisitions will be targeted towards existing or upcoming major highways and other forms of rapid transit networks appropriate to the market (light rail transit, commuter transit, subways)

Attractive Secondary Markets

Bayfield will target risk-adjusted opportunities in captive well-populated markets

Sample areas include submarkets within GTHA, GVA, GCA, GEA, NCR, etc.

Stabilized & Redevelopment Properties: A Formula for Exceptional Private Equity Investment Opportunities

We’ve found that our strategy works best when it’s applied to two types of commercial real estate: stabilized and redevelopment properties.Combined with our disciplined approach, we are able to create long-term value for our private equity investors by providing a product that becomes the top strategy to use when defending their portfolio against market uncertainty.