Trusted By Our Investors Since 2005

Bayfield Realty Advisors Inc. was established in 2005 as a private equity investment firm focusing primarily on commercial real estate assets across Canada. Spearheaded by Founder and CEO Harold Spring, we have become a top tier private equity real estate investment firm by using an investment strategy that adheres to one disciplined approach: opportunistically acquire investment properties while enhancing value through aggressive leasing, redevelopment, management and disposition.

Why Bayfield?

Proven Track Record

Bayfield has a track record of creating value through a disciplined investment program of acquiring stabilized and opportunistic assets, while enhancing value through aggressive leasing, development, management and disposition

Experienced Leadership

The majority of the Bayfield team has worked together for 10+ years and collectively bring over 100 years of real estate experience amongst a diverse cross section of seasoned professionals

Attractive Risk Adjusted Returns

The Bayfield’s strategy is well positioned to take advantage of market trends in retail and industrial asset classes that are uncorrelated to public equity markets

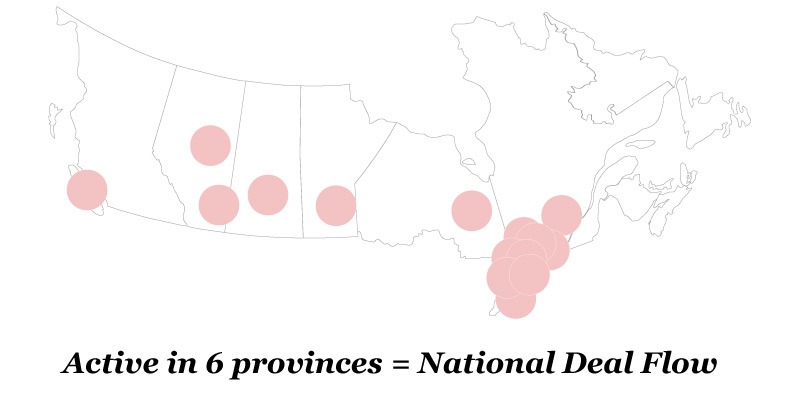

Strong Deal Flow

Bayfield has access to opportunities through traditional channels, off-market opportunities, and deals arising through its strategic partners, such as RioCan Real Estate Investment Trust.

A Strong Portfolio & National Co-Venture Partners

Fast forward 12 years and Bayfield has become one of Canada’s leading real estate investment and asset management firms, solidified by a real estate investment portfolio value of about $500 million dollars (with a total net leasable area of over 3 million square feet) and strong co-venture partnerships with national institutional investors and partners such as RioCan Real Estate Investment Trust, Dream and CREIT.

Manager Snapshot

- AUM – $500 million of Assets Under Management

- Critical Mass – Over 3 million square feet of net leasable area across 20 high quality assets

- Yield – Over $25+ million of expected Net Operating Income in 2020

- Active Managers – Over $54 million in construction/renovation projects completed (with $28.8 million in the pipeline)

Existing Portfolio

Razor-Sharp Focus

Bayfield doesn’t acquire every type of real estate: we focus only on commercial and industrial real estate because it is an attractive real estate investment model that presents a large upside and higher net operating income (NOI), while providing the opportunity to have properties that are valued higher due to the low capitalization rates unique to these types of assets. Over the years, this strategy has proven to be a stable and profitable focus for our clients.

High Yields, Low Volatility

Bayfield’s success is largely owed to its high net worth individual and institutional investors. Our investment approach has always sought to maximize the return on every client’s’ capital while providing the best defensive strategy for dealing with market uncertainty—and each client’s ongoing trust in us is a strong testament to our ability to bring high yields while protecting them from volatility.